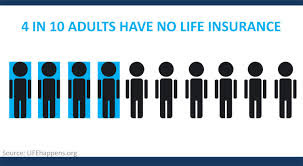

Have you ever seen a sign like this? We have and we don't like it!!! Don't let this happen to your family and friends. You should not want your friends and family to have a car wash, set up a gofundme.com account or any sort of fund raiser after you pass to pay for the unexpected costs without life insurance to help.

You would be surprised how little it costs for life insurance to avoid this. An article on fatwallet.com shares about the unexpected costs that can occur.

Immediate Expenses: In our spending culture, few families have saved thousands of dollars that rest in a savings account for use when the unthinkable happens. Retirement accounts, stocks and bonds are investment instruments that are not immediately available. In the event of a loved one passing away, the surviving family members will have immediate expenses that must be covered within the first 30 days. Funeral expenses – Costs associated with transporting a body, burial and funeral services can exceed $10,000. No one wants to settle for a simple memorial service when the person means so much to them. And so the family should not be burdened with years of debt because these costs were unaffordable.

Monthly obligations – Bills will continue to arrive from every creditor. Credit card fees will mount quickly if the survivors are left with no money to pay the bills. And the phone calls to creditors will only delay the costs for a short time if the survivor remembers to address the situation.

Family needs – Children and families have daily needs that require a certain amount of cash on a daily basis usually provided by the earning member. If the diseased happens to the sole earner or the major contributor to family income, the survivor must have sufficient funds to pay school bills, daycare providers and pay for the groceries. A credit card delays the inevitable, which could have been paid with the proceeds from a life insurance policy. Transition Costs Legal expenses arise as the survivor discovers the details that must be addressed to live without the deceased. Large assets cannot remain in the ownership of the person who is no longer living. Attorneys expect full payment of fees to address these significant legal transactions.

Home ownership – The lender who holds the mortgage will require transfer of the mortgage to the survivor. Life insurance proceeds would have been used to repay the mortgage in full, which would provide housing for the family. Few families are able to remain in the family home following the death of an uninsured wage earner.

Business ownership – One in five businesses will survive the loss of an owner, or principal. Transition expenses for a business can exceed $1 million. Life insurance coverage on the business owner would be used to acquire expertise and sustain the employees’ salaries until the business could be sold.

Notifying interested parties – Legal transactions require the survivor to acquire multiple copies of the death certificate. Expenses associated with ownership details can accumulate quickly because of the copies, postage and legal documents that are required. A young surviving spouse will incur financial hardship that could have been avoided with life insurance proceeds.

September is Life Insurance Awareness month. Call April Schaffroth at Farmers Insurance today at 602-297-5155 or www.insuranceinaz.com